#NY 2022 TAX BRACKETS HOW TO#

Watch the video below to learn how to identify your 2022 federal income tax brackets. Check New York Form IT-201 (for residents) and Form IT-203 (for nonresidents/part-year residents) for more information on how that tax is calculated. This amount is calculated based on your earnings and your tax-filing status (married filing jointly, single or married filing separately, or head of household). $2,479,135, and 10.9% of income over $25,000,000Īll residents, whether you're a single or joint filer, who have an adjusted gross income over $107,650 also pay a supplemental tax. Source: New York State Department of Taxation and Finance The next $8,501 to $11,700 would be taxed at $340 plus 4.5 percent and so on. For example, if you're a single filer who earned $80,000, the first $8,500 would be taxed at 4 percent. Note that all of your income is not taxed at the same rate. New York City and Yonkers both add local income taxes on top of state income tax.

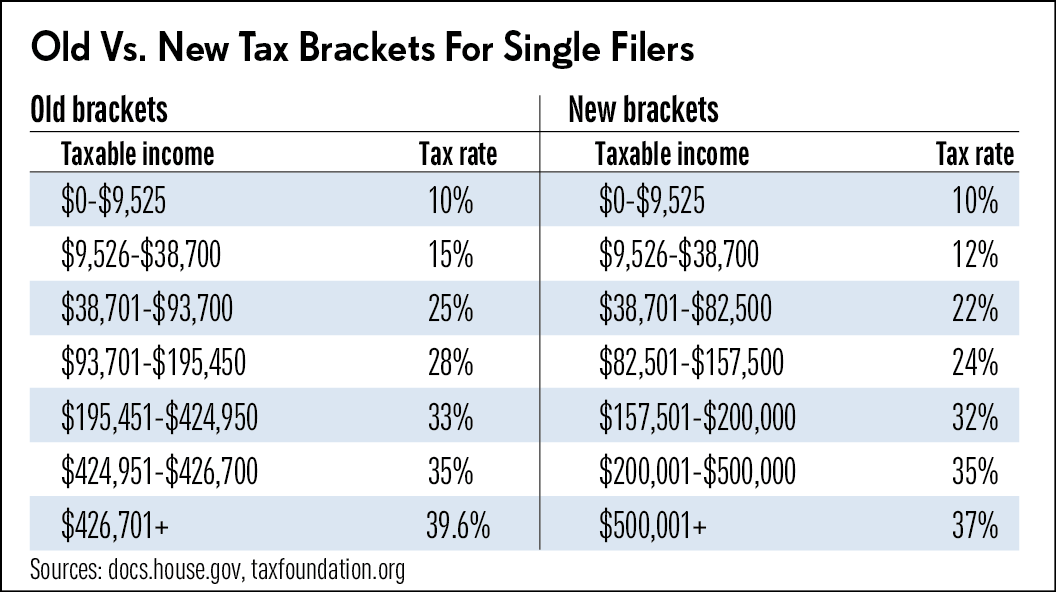

How is income taxed in New York?The state’s nine tax brackets are below.

0 kommentar(er)

0 kommentar(er)